Investigating the Impact of Ownership Structure and Board Characteristics on Accounting Conservatism in Financial Reports of Iraq and UAE

Keywords:

board size, board independence, managerial ownership, institutional ownershipAbstract

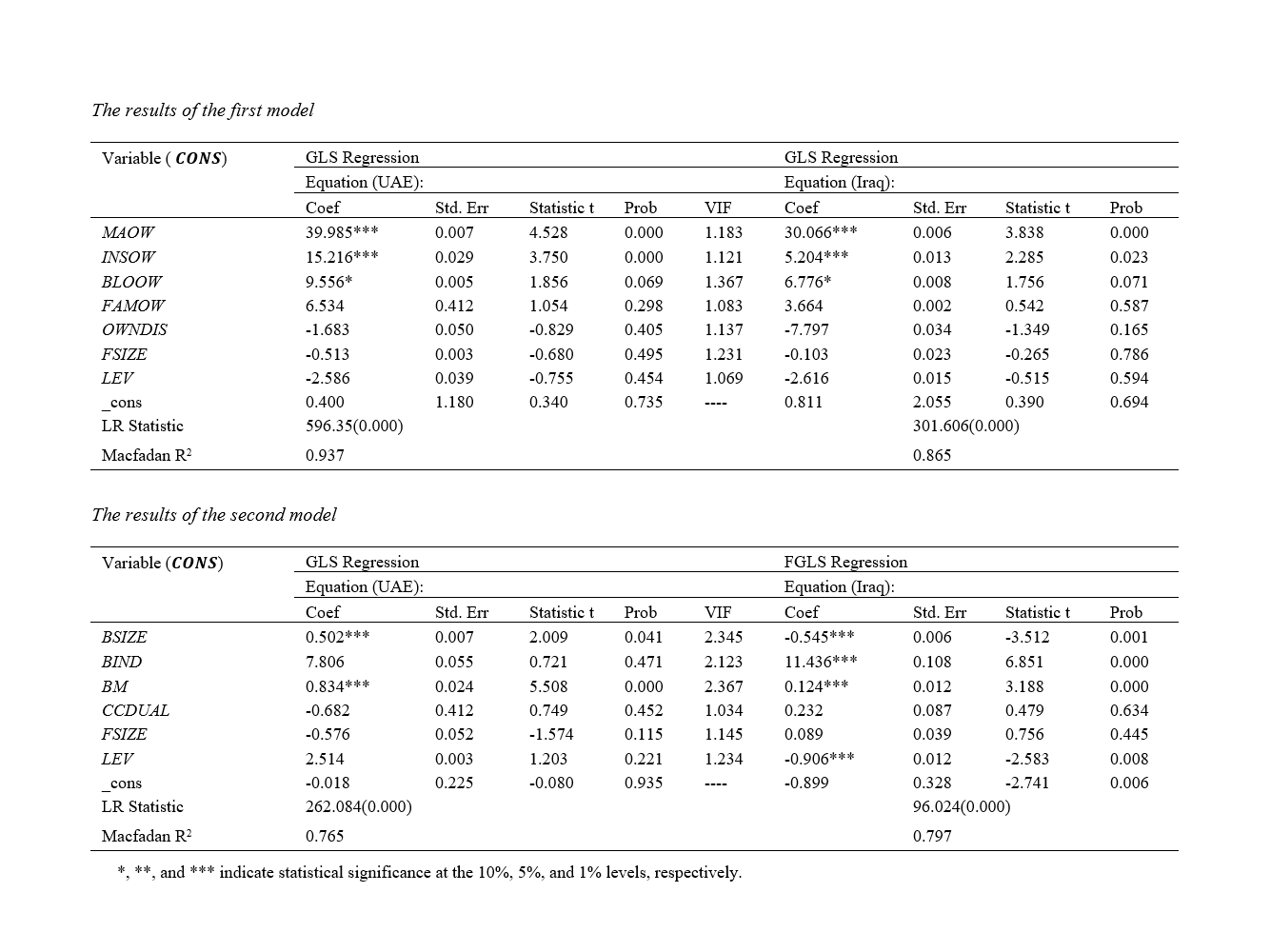

Objective: This study examines the impact of corporate governance mechanisms on accounting conservatism in companies listed on the Iraq and UAE stock exchanges.

Methods and Materials: The statistical sample of the study was selected systematically from companies listed on the Iraq and UAE stock exchanges during the period from 2016 to 2022. This sample includes 31 companies from the Baghdad Stock Exchange and 52 companies from the Abu Dhabi and Dubai stock exchanges. Additionally, the hypotheses of the study were tested using the panel data regression method.

Findings: The results of hypothesis testing indicated that the board size, board independence, managerial ownership, and institutional ownership have a positive and significant impact on accounting conservatism in companies listed on the UAE stock exchange. Moreover, the results showed that only board size has a negative and significant relationship with conservatism in the Iraq stock exchange, while the other results were similar to those of the UAE stock exchange.

Conclusion: The study concludes that board characteristics and ownership structure significantly influence accounting conservatism in Iraq and UAE, with notable differences observed in board size's impact across the two markets.

Downloads

References

Abdou, H. A., Ellelly, N. N., Elamer, A. A., Hussainey, K., & Yazdifar, H. (2021). Corporate governance and earnings management nexus: Evidence from the UK and Egypt using neural networks. International Journal of Finance & Economics, 26(4), 6281-6311. https://doi.org/10.1002/ijfe.2120

Almaqtari, F. A., Hashed, A. A., Shamim, M., & Al-Ahdal, W. M. (2021). Impact of corporate governance mechanisms on financial reporting quality: a study of Indian GAAP and Indian Accounting Standards. Problems and Perspectives in Management, 18(4), 1. https://doi.org/10.21511/ppm.18(4).2020.01

Almutairi, A. R., & Quttainah, M. A. (2020). Foreign directors and corporate governance in Islamic banks. Journal of Islamic Accounting and Business Research, 11(4), 765-791. https://doi.org/10.1108/JIABR-07-2017-0104

Alves, S. (2021). Accounting conservatism and board characteristics: Portuguese evidence. International Journal of Business and Society, 22(3), 1346-1362. https://doi.org/10.33736/ijbs.4305.2021

Anagnostopoulou, S. C., Tsekrekos, A. E., & Voulgaris, G. (2021). Accounting conservatism and corporate social responsibility. The British Accounting Review, 53(4), 100942. https://doi.org/10.1016/j.bar.2020.100942

Biddle, G. C., Ma, M. L., & Song, F. M. (2022). Accounting conservatism and bankruptcy risk. Journal of Accounting, Auditing & Finance, 37(2), 295-323. https://doi.org/10.1177/0148558X20934244

Boachie, C., & Mensah, E. (2022). The effect of earnings management on firm performance: The moderating role of corporate governance quality. International Review of Financial Analysis, 83, 102270. https://doi.org/10.1016/j.irfa.2022.102270

Boshnak, H. A. (2021). Corporate governance mechanisms and firm performance in Saudi Arabia. International Journal of Financial Research, 12(3), 446-465. https://doi.org/10.5430/ijfr.v12n3p446

Cho, S. Y., Kang, P. K., Lee, C., & Park, C. (2020). Financial reporting conservatism and voluntary CSR disclosure. Accounting Horizons, 34(2), 63-82. https://doi.org/10.2308/horizons-17-093

Cui, L., Kent, P., Kim, S., & Li, S. (2021). Accounting conservatism and firm performance during the COVID‐19 pandemic. Accounting & Finance, 61(4), 5543-5579. https://doi.org/10.1111/acfi.12767

D'Augusta, C., & DeAngelis, M. D. (2020). Does accounting conservatism discipline qualitative disclosure? Evidence from tone management in the MD&A. Contemporary Accounting Research, 37(4), 2287-2318. https://doi.org/10.1111/1911-3846.12598

Dai, L., & Ngo, P. (2021). Political uncertainty and accounting conservatism. European Accounting Review, 30(2), 277-307. https://doi.org/10.1080/09638180.2020.1760117

Daryaei, A. A., Fattahi, Y., Hasani, R., & Sadeqi, H. (2020). Value of cash and accounting conservatism: The role of audit quality and firm growth. Cogent Economics & Finance, 8(1), 1816281. https://doi.org/10.1080/23322039.2020.1816281

Elnahass, M., Salama, A., & Yusuf, N. (2022). Earnings management and internal governance mechanisms: the role of religiosity. Research in International Business and Finance, 59, 101565. https://doi.org/10.1016/j.ribaf.2021.101565

Elnahass, M., Tahir, M., Abdul Rahman Ahmed, N., & Salama, A. (2024). Internal governance mechanisms and information value of banks' earnings. Journal of Accounting in Emerging Economies, 14(2), 450-488. https://doi.org/10.1108/JAEE-09-2020-0247

Gerged, A. M., Albitar, K., & Al‐Haddad, L. (2023). Corporate environmental disclosure and earnings management-The moderating role of corporate governance structures. International Journal of Finance & Economics, 28(3), 2789-2810. https://doi.org/10.1002/ijfe.2564

Guermazi, W., & Halioui, K. (2020). Do differences in national cultures affect cross-country conditional conservatism behavior under IFRS? Research in International Business and Finance, 52, 101171. https://doi.org/10.1016/j.ribaf.2019.101171

Haider, I., Singh, H., & Sultana, N. (2021). Managerial ability and accounting conservatism. Journal of Contemporary Accounting & Economics, 17(1), 100242. https://doi.org/10.1016/j.jcae.2020.100242

Hasan, A., Aly, D., & Hussainey, K. (2022). Corporate governance and financial reporting quality: a comparative study. Corporate Governance: The International Journal of Business in Society, 22(6), 1308-1326. https://doi.org/10.1108/CG-08-2021-0298

Hashed, A., & Almaqtari, F. (2021). The impact of corporate governance mechanisms and IFRS on earning management in Saudi Arabia. Accounting, 7(1), 207-224. https://doi.org/10.5267/j.ac.2020.9.015

Javaid, A., Nazir, M. S., & Fatima, K. (2023). Impact of corporate governance on capital structure: mediating role of cost of capital. Journal of Economic and Administrative Sciences, 39(4), 760-780. https://doi.org/10.1108/JEAS-09-2020-0157

Khalil, M., Ozkanc, A., & Yildiz, Y. (2020). Foreign institutional ownership and demand for accounting conservatism: evidence from an emerging market. Review of Quantitative Finance and Accounting, 55, 1-27. https://doi.org/10.1007/s11156-019-00834-3

Khalilov, A., & Osma, B. G. (2020). Accounting conservatism and the profitability of corporate insiders. Journal of Business Finance & Accounting, 47(3-4), 333-364. https://doi.org/10.1111/jbfa.12438

Khan, S., Kamal, Y., Hussain, S., & Abbas, M. (2022). Corporate governance looking back to look forward in Pakistan: a review, synthesis and future research agenda. Future Business Journal, 8(1), 24. https://doi.org/10.1186/s43093-022-00137-5

Krismiaji, K., & Surifah, S. (2020). Corporate governance, compliance level of IFRS disclosure and value relevance of accounting information-Indonesian evidence. Journal of International Studies (2071-8330), 13(2). https://doi.org/10.14254/2071-8330.2020/13-2/14

Lobo, G. J., Robin, A., & Wu, K. (2020). Share repurchases and accounting conservatism. Review of Quantitative Finance and Accounting, 54, 699-733. https://doi.org/10.1007/s11156-019-00804-9

Nur, M., Molina, M., Indriyanto, E., & Digdowiseiso, K. (2023). Determinants of the Selection of Accounting Conservatism in Indonesia: A Systematic Literature Review Approach. Global Journal of Business, Economics & Social Development, 1(2), 64-77. https://doi.org/10.56225/gjbesd.v1i2.9

Pinto, I., Gaio, C., & Gonçalves, T. (2020). Corporate governance, foreign direct investment, and bank income smoothing in African countries. International Journal of Emerging Markets, 15(4), 670-690. https://doi.org/10.1108/IJOEM-04-2019-0297

Salehi, M., Lari DashtBayaz, M., Hassanpour, S., & Tarighi, H. (2020). The effect of managerial overconfidence on the conditional conservatism and real earnings management. Journal of Islamic Accounting and Business Research, 11(3), 708-720. https://doi.org/10.1108/JIABR-03-2017-0030

Shaw, T. S., Raithatha, M., Krishnan, G. V., & Cordeiro, J. J. (2021). Did mandatory CSR compliance impact accounting Conservatism? Evidence from the Indian Companies Act 2013. Journal of Contemporary Accounting & Economics, 17(3), 100280. https://doi.org/10.1016/j.jcae.2021.100280

Thesing, J., & Velte, P. (2021). Do fair value measurements affect accounting-based earnings quality? A literature review with a focus on corporate governance as moderator. Journal of Business Economics, 91(7), 965-1004. https://doi.org/10.1007/s11573-020-01025-6

Wang, R., Zhou, S., & Wang, T. (2020). Corporate governance, integrated reporting and the use of credibility-enhancing mechanisms on integrated reports. European Accounting Review, 29(4), 631-663. https://doi.org/10.1080/09638180.2019.1668281

Zadeh, F. N., Askarany, D., & Asl, S. A. (2022). Accounting conservatism and earnings quality. Journal of Risk and Financial Management, 15(9), 413. https://doi.org/10.3390/jrfm15090413

Downloads

Additional Files

Published

Submitted

Revised

Accepted

Issue

Section

License

Copyright (c) 2025 Waleed Mohsin Owaid AL- Zubaidi, Rahman Saedi, Ibrahim Abed Mousa Alsabary , Mohsen Rahimi Dastjerdi (Author)

This work is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License.