Institutional Isomorphism Model and Its Impact on Environmental, Social, and Corporate Governance Reporting

Keywords:

Institutional isomorphism model, coercive isomorphism, normative isomorphism, mimetic isomorphism, environmental reporting, social reporting, corporate governance reportingAbstract

Objective: The aim of this research is to present an institutional isomorphism model and examine its impact on environmental, social, and corporate governance reporting.

Methodology: This study employs a mixed-methods approach, conducted simultaneously. The quantitative part is descriptive-survey and correlational, with data collected from 385 managers of publicly traded companies on the Tehran Stock Exchange through a questionnaire. The data were analyzed using LISREL software. In the second part of the study, a qualitative approach using ethnography and purposive sampling was employed to collect data from individuals holding doctoral degrees in accounting and working in publicly traded companies on the Tehran Stock Exchange. The data were analyzed using thematic analysis and content analysis methods.

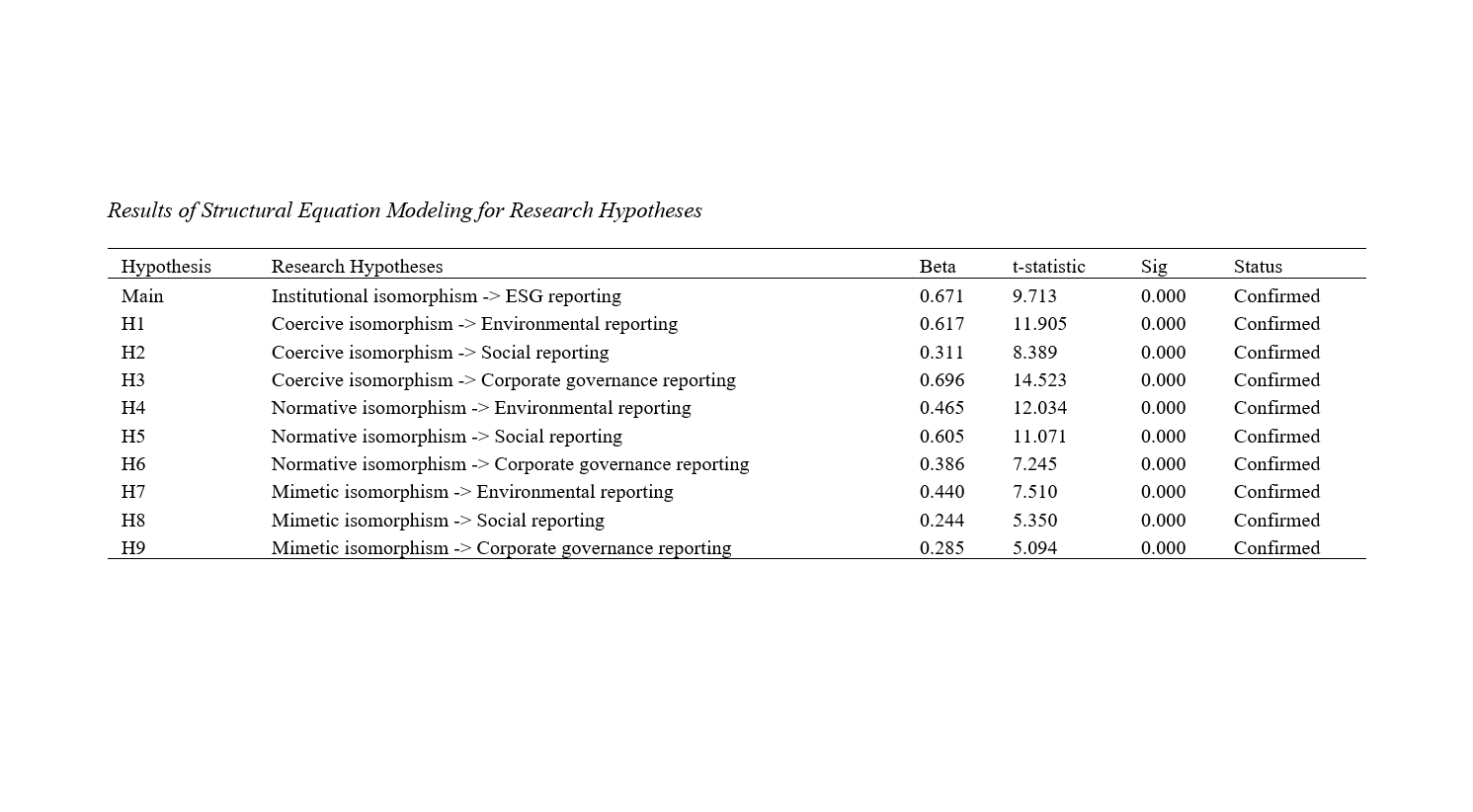

Findings: Based on the findings of the first study, the institutional isomorphism factors (coercive, normative, and mimetic) explain 65.9% of the variance in environmental, social, and corporate governance reporting. Additionally, in the second study, after conducting interviews with 10 participants, a total of 33 categories were identified during the open coding phase, which were considered as the main categories. The category of labor rights had the most repetitions in the interviews, and the categories of performance compensation, labor rights, and corporate social responsibility investment were repeated in all interviews. During the axial coding phase, the 33 main categories were classified into four categories: social dimension, corporate governance, environmental dimension, and finally, institutional isomorphism. The environmental dimension, with 10 main categories and 96 repetitions in the interviews, had the highest number of repetitions, with the categories of corporate social responsibility investment, biodiversity, and environmental issues in products, services, and supply chains being the most important from the interviewees’ perspectives. The social dimension, with 11 main categories and 183 repetitions, had the highest frequency, with the categories of labor rights, social issues related to customers and the supply chain, stakeholder social perceptions, and health, safety, and productivity being the most important. Finally, the corporate governance dimension, with 9 main categories and 105 repetitions, had the most importance in the interviews, with the categories of investment risk management and performance compensation being the most significant. In the selective coding phase, the social dimension, with 11 main categories, was introduced as the central category.

Conclusion: This study highlights the critical role of institutional pressures—coercive, normative, and mimetic—in shaping sustainability assurance practices. By addressing legal, cultural, and industry-specific factors, it underscores assurance as a vital tool for legitimacy and stakeholder alignment. The findings advance institutional theory and offer practical insights for policymakers, companies, and stakeholders.

Downloads

References

Alsaid, L. A. Z. A., & Ambilichu, C. A. (2024). Performance measurement in urban development: unfolding a case of sustainability KPIs reporting. Journal of Accounting in Emerging Economies, 14(1), 48-74. https://doi.org/10.1108/JAEE-09-2021-0299

Amoako, G. K., Anokye, M. A., Clement, L. A., & George, T. (2021). Institutional isomorphism, environmental management accounting and environmental accountability: a review. Environment, Development and Sustainability. https://doi.org/10.1007/s10668-020-01140-y

Boxenbaum, E., & Jonsson, S. (2008). Isomorphism, diffusion and decoupling. In R. Greenwood, C. Oliver, R. Suddaby, & K. Sahlin (Eds.), The SAGE handbook of organizational institutionalism (pp. 78-98). SAGE Publications. https://doi.org/10.4135/9781849200387.n3

Campbell, J. L. (2007). Why would corporations behave in socially responsible ways? An institutional theory of corporate social responsibility. Academy of Management Review, 32(3), 946-967. https://doi.org/10.5465/amr.2007.25275684

Clarkson, P. M., Li, Y., Richardson, G. D., & Vasvari, F. P. (2008). Revisiting the relation between environmental performance and environmental disclosure: an empirical analysis. Accounting, Organizations and Society, 33(4), 303-327. https://doi.org/10.1016/j.aos.2007.05.003

Cormier, D., Magnan, M., & Van Velthoven, B. (2005). Environmental disclosure quality in large German companies: economic incentives, public pressures or institutional conditions? European Accounting Review, 14(1), 3-39. https://doi.org/10.1080/0963818042000339617

Crisóstomo, V. L., Freire, F. d. S., & Freitas, M. R. D. O. (2020). Determinants of corporate sustainability performance – evidence from Brazilian panel data. Social Responsibility Journal, 16(8), 1053-1072. https://doi.org/10.1108/SRJ-04-2018-0102

Deegan, C. (2002). Introduction: the legitimising effect of social and environmental disclosures-a theoretical foundation. Accounting, Auditing & Accountability Journal, 15(3), 282-311. https://doi.org/10.1108/09513570210435852

Deegan, C., Cooper, B. J., & Shelly, M. (2006). An investigation of TBL report assurance statements: UK and European evidence. Managerial Auditing Journal, 21(4), 329-371. https://doi.org/10.1108/02686900610661388

Deephouse, D. L., & Carter, S. M. (2005). An examination of differences between organizational legitimacy and organizational reputation. Journal of Management Studies, 42(2), 329-360. https://doi.org/10.1111/j.1467-6486.2005.00499.x

Dhaliwal, D. S., Radhakrishnan, S., Tsang, A., & Yang, Y. G. (2012). Nonfinancial disclosure and analyst forecast accuracy: international evidence on corporate social responsibility disclosure. The Accounting Review, 87(3), 723-759. https://doi.org/10.2308/accr-10218

DiMaggio, P. J., & Powell, W. W. (1983). The iron cage revised: institutional isomorphism and collective rationality in organizational fields. American Sociological Review, 48(2), 147-160. https://doi.org/10.2307/2095101

Durnev, A., & Kim, E. (2005). To steal or not to steal: firm attributes, legal environment, and valuation. The Journal of Finance, 60(3), 1461-1493. https://doi.org/10.1111/j.1540-6261.2005.00767.x

Francis, J. R., Khurana, I. K., Martin, X., & Pereira, R. (2011). The relative importance of firm incentives versus country factors in the demand for assurance services by private entities. Contemporary Accounting Research, 28(2), 487-516. https://doi.org/10.1111/j.1911-3846.2010.01053.x

Gardazi, S. S. N., Hassan, A. F. S., & Bello, M. S. (2023). A Bibliometric Analysis of Corporate Sustainability Performance: Current Status, Development and Future Trends. International Journal of Professional Business Review, 8(3), e0367. https://doi.org/10.26668/businessreview/2023.v8i3.367

Irigaray, H. A. R. (2024). Reflections on Business Resilience, Corporate Governance, and Corporate Social Responsibility. Cadernos Ebape Br, 22(1). https://doi.org/10.1590/1679-395190025x

Kolk, A., & Perego, P. (2010). Determinants of the adoption of sustainability assurance statements: an international investigation. Business Strategy and the Environment, 19(3), 182-198. https://doi.org/10.1002/bse.643

Lowe, D. J., & Reckers, P. M. J. (2024). The Deterrence Effects of Whistleblowing Provisions, Corporate Governance Culture, and Machiavellianism. Behavioral Research in Accounting, 36(1), 45-65. https://doi.org/10.2308/BRIA-2022-041

Mahmudi, B. (2024). Corporate Governance Mechanisms and Financial Performance: A Systematic Literature Review in Emerging Markets. Productivity, 1(3), 270-285. https://doi.org/10.62207/gqtv4c76

Morimoto, R., Ash, J., & Hope, C. (2005). Corporate social responsibility audit: from theory to practice. Journal of Business Ethics, 62(4), 315-325. https://doi.org/10.1007/s10551-005-0274-5

Moroney, R., Windsor, C., & Aw, Y. T. (2012). Evidence of assurance enhancing the quality of voluntary environmental disclosures: an empirical analysis. Accounting & Finance, 52(3), 903-939. https://doi.org/10.1111/j.1467-629X.2011.00413.x

Ni Luh Putu Agustin Nirmala, S. (2024). Does Good Corporate Governance and Political Connection Have an Influence a Tax Avoidance? Formosa Journal of Multidisciplinary Research, 3(3), 253-262. https://doi.org/10.55927/fjmr.v3i3.8584

North, D. C. (1990). Institutions, institutional change and economic performance. Cambridge University Press. https://doi.org/10.1017/CBO9780511808678

Perego, P. (2009). Causes and consequences of choosing different assurance providers: an international study of sustainability reporting. International Journal of Management, 26(3), 412-425. https://core.ac.uk/download/pdf/18521288.pdf

Peters, G. F., & Romi, A. M. (2014). The association between sustainability governance characteristics and the assurance of corporate sustainability reports. Auditing: A Journal of Practice & Theory, 34(1), 163-198. https://doi.org/10.2308/ajpt-50849

Scott, W. R. (2008). Approaching adulthood: the maturing of institutional theory. Theory and Society, 37(5), 427-442. https://doi.org/10.1007/s11186-008-9067-z

Simnett, R., Vanstraelen, A., & Chua, W. F. (2009). Assurance on sustainability reports: an international comparison. The Accounting Review, 84(3), 937-967. https://doi.org/10.2308/accr.2009.84.3.937

Thoan, L. T. (2024). Corporate Governance in Listed Firms: Does Market Competition Make a Difference? Asian Academy of Management Journal, 29(1), 171-203. https://doi.org/10.21315/aamj2024.29.1.7

Weber, J. (2014). Corporate social responsibility disclosure level, external assurance and cost of equity capital. External Assurance and Cost of Equity Capital. https://doi.org/10.2139/ssrn.2538948

Wong, R., & Millington, A. (2014). Corporate social disclosures: a user perspective on assurance Accounting. Auditing & Accountability Journal, 27(5), 863-887. https://doi.org/10.1108/AAAJ-06-2013-1389

Zhou, S., Simnett, R., & Green, W. (2013). The effect of legal environment and corporate governance on the decision to assure and assurance provider choice: evidence from the GHG assurance market. UNSW Australian School of Business Research Paper. https://doi.org/10.2139/ssrn.2147359

Downloads

Additional Files

Published

Submitted

Revised

Accepted

Issue

Section

License

Copyright (c) 2024 Saeed Mohammadnezhad (Author); Samad Ayazi (Corresponding Author); Arash Naderian (Author)

This work is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License.