Financial Performance Evaluation Using Various Economic Value Added Measures in the Consumer Sector of the Iraq Stock Exchange

Keywords:

Economic Value Added, Economic Value Added Momentum, Financial Performance, Consumer IndustriesAbstract

Objective: This study aims to evaluate the impact of three contemporary economic performance metrics on the financial performance of consumer sector companies listed on the Iraq Stock Exchange.

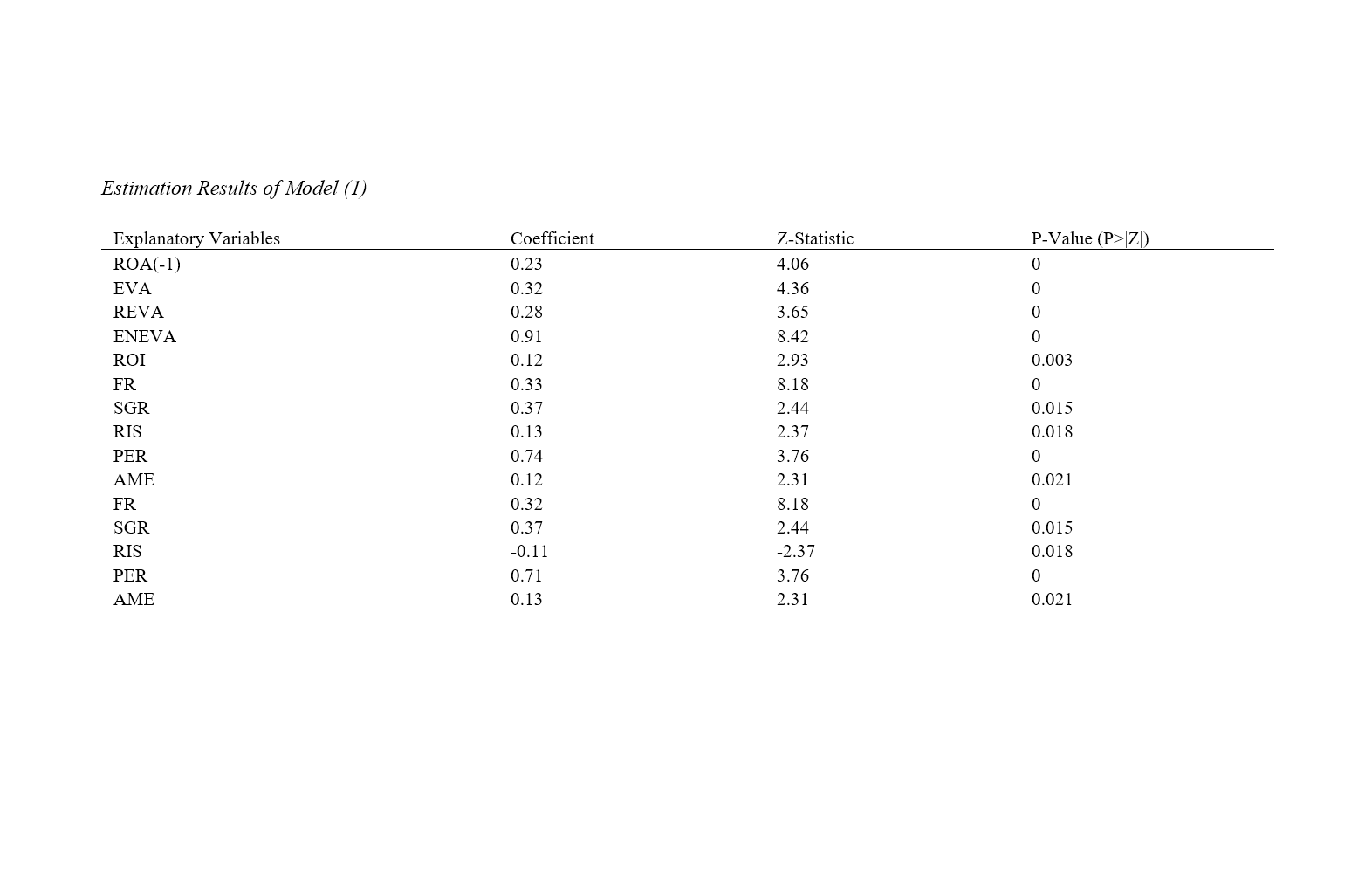

Methodology: A dynamic panel data approach using the Arellano and Bond method was employed to analyze data from 16 companies over 7 years. Variables including EVA, REVA, ENEVA, Return on Investment (ROI), financial ratios, sales growth rate, financial risk, market indicators, and advertising expenditures were evaluated for their influence on return on assets (ROA).

Findings: All three EVA metrics showed significant positive effects on financial performance, with REVA identified as the most effective measure. ROI, financial ratios, sales growth rate, and advertising expenditures also positively influenced ROA, while financial risk negatively impacted performance. The Sargan and serial correlation tests confirmed the validity of the instruments and model.

Conclusion: The results emphasize the utility of EVA-based metrics, particularly REVA, as robust tools for financial performance evaluation and improvement in the consumer sector. These metrics provide a comprehensive perspective by incorporating capital costs, enabling firms to identify improvement opportunities and enhance long-term shareholder value.

Downloads

References

Alrawashedh, N. H. (2024). Impact of Digital Transformation on the Organization’s Financial Performance: A Case of Jordanian Commercial Banks Listed on the Amman Stock Exchange. Banks and Bank Systems, 19(1), 126-134. https://doi.org/10.21511/bbs.19(1).2024.11

Bayrakdaroglu, A., & Yalcin, N. (2012). Strategic financial performance evaluation of the Turkish companies traded on ISE-30 using fuzzy AHP and VIKOR methods. Technological and Economic Development of Economy, 18(1), 14-30. https://doi.org/10.3846/20294913.2012.661192

Biddle, G. C., Bowen, R. M., & Wallace, J. S. (2001). Evidence on EVA. Journal of Applied Corporate Finance, 13(2), 69-79. https://doi.org/10.1111/j.1745-6622.1999.tb00008.x

Chen, S., & Dodd, J. L. (2005). Economic Value Added (EVA™): An Empirical Examination of a New Corporate Performance Measure. Journal of Managerial Issues, 9(3), 318-333. https://www.jstor.org/stable/40604150

Fahrian, A., & Nasution, M. I. P. (2023). Financial Performance Information System Using Economic Value Added Method. Journal of Computer Networks, Architecture and High Performance Computing, 5(2), 238-249. https://doi.org/10.47709/cnahpc.v5i2.2380

Faryadras, R., Chavoshi, S. K., & Sharifi, S. (2024). Examining the relationship between resilience, financial performance, and business continuity in companies listed on the Tehran Stock Exchange. Investment Knowledge.

Hashemi, S. (2024). Investigating the impact of sustainability performance and governance on the financial performance of banks listed on the Tehran Stock Exchange. Seventh International Conference and Eighth National Conference on New Findings in Management, Psychology, and Accounting. https://civilica.com/doc/2284859/

Indriakati, A. J. (2023). Financial Performance Analysis Using the Economic Value Added Method in Cosmetic Companies Listed on Indonesia Stock Exchange. Advances in Applied Accounting Research, 1(2), 89-98. https://doi.org/10.60079/aaar.v1i2.89

Khan, M., & Bradbury, M. (2005). The Influence of Valuation Roles on the Decision Usefulness of EVA and NOPAT Measures: Evidence from New Zealand. The Journal of Applied Business Research, 21(3), 27-42. https://www.researchgate.net/publication/323503321

King, R., & Henry, E. (2016). The Impact of Enhanced EVA on Financial Performance: An Empirical Analysis. Journal of Financial Analysis, 12(4), 24-36. https://doi.org/10.1515/fiqf-2016-0142

Milbourn, T. T., Thakor, A. V., & Valkanov, R. I. (2010). The Impact of Economic Value Added on the Performance of Financial Institutions. Journal of Banking & Finance, 34(3), 449-460. https://ccsenet.org/journal/index.php/ijef/article/view/0/36886

Omneya, A. K., Ashraf, S., & Eldin, B. B. (2021). Is Economic Value Added Momentum (EVA Momentum) a Better Performance Measurement Tool? Evidence from Egyptian Listed Firms. American Journal of Industrial and Business Management, 11, 297-319. https://doi.org/10.4236/ajibm.2021.113019

Qian, R. (2023). Management of Personal Finances and Investment Decisions. Advances in Economics Management and Political Sciences, 64(1), 202-212. https://doi.org/10.54254/2754-1169/64/20231532

Sundari, A., Rozi, A. F., Bilgies, A. F., & Muhajir, A. (2023). Financial Performance Analysis Using Economic Value Added and Market Value Added Methods in Cement Sub-sector Companies Listed on Indonesia Stock Exchange. Journal of Tourism Economics and Policy, 3(1), 1-11. https://doi.org/10.38142/jtep.v3i1.546

Yousefi Ghaleh-Roudkhani, M. A., Tehrani, R., & Mirlohi, S. M. (2023). Relationship between financial performance and financial stability of banks listed on Tehran Stock Exchange and Iran Fara Bourse. Securities Exchange Quarterly, 16(62), 53-74.

Yousefi Qaleh Roudkhani, M. A., Tehrani, R., & Mirlohi, S. M. (2023). The relationship between financial performance and financial stability of banks listed on the Tehran Stock Exchange and Iran's over-the-counter market. Stock Exchange Journal, 16, 62.

Downloads

Additional Files

Published

Submitted

Revised

Accepted

Issue

Section

License

Copyright (c) 2025 Osama Abdulsalam al-bunajim (Author); Sara Ghobadi (Corresponding Author); Abdulrazzaq Mohamad Hussein, Hossein Sharifi Renani (Author)

This work is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License.