Explaining the Behavioral Model of Auditors Based on Environmental Responsibility

Keywords:

Model, Behavior, Social Responsibility, Auditors, EnvironmentAbstract

Objective: The present study aims to explain the behavioral model of auditors based on environmental responsibility.

Methodology: The research employs a mixed-methods approach (qualitative and quantitative) and was conducted in 2024. In the qualitative phase, data were collected through interviews with 15 experts, achieving theoretical saturation using the grounded theory method. In the quantitative phase, the Friedman test was employed to rank the dimensions and components of the model. Additionally, the model's validity was assessed by distributing a researcher-developed questionnaire among 384 experts, including faculty members, financial managers, and auditors from the Supreme Audit Court of the country, using SPSS software.

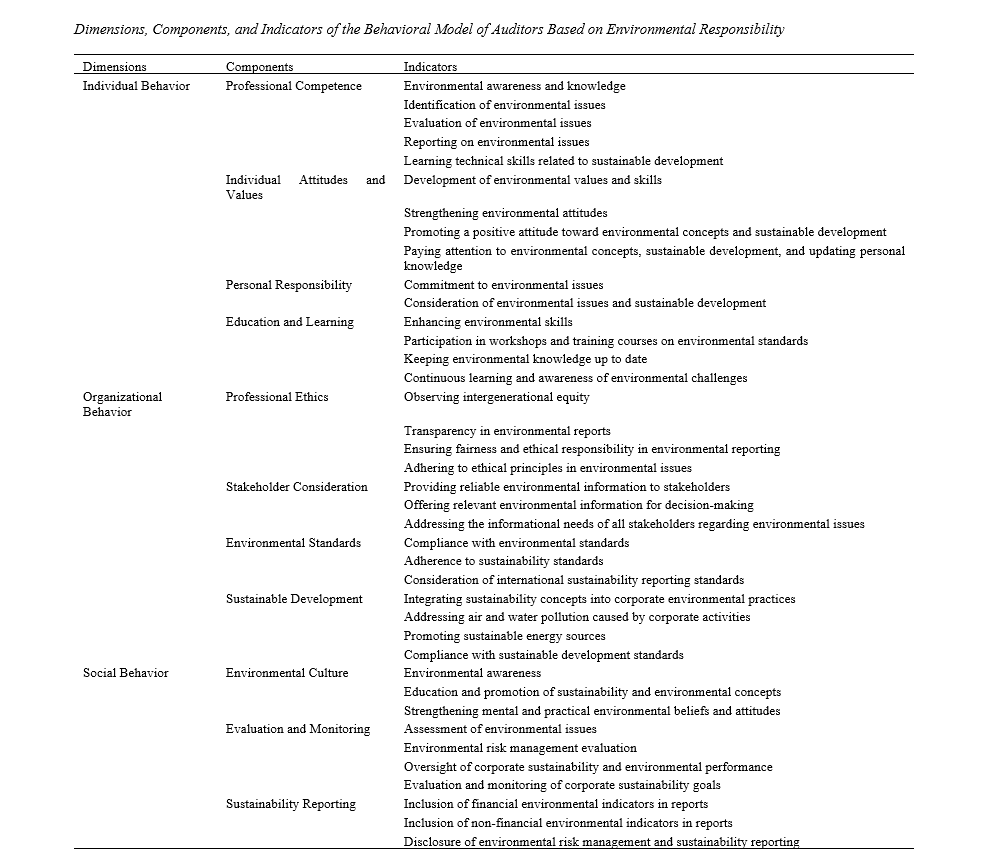

Findings: The proposed model comprises three dimensions, 11 components, and 39 indicators. The dimensions of the behavioral model of auditors based on environmental responsibility include the organizational behavior dimension, which encompasses professional ethics, stakeholder consideration, environmental standards, and sustainable development; the social behavior dimension, which includes environmental culture, evaluation and monitoring, and sustainability reporting; and the individual behavior dimension, which consists of professional competence, individual attitudes and values, personal responsibility, and education and learning.

Conclusion: Auditors must acquire the necessary skills to identify, evaluate, and report environmental issues. These skills include knowledge of environmental accounting and reporting across individual, organizational, and social behavioral dimensions, environmental risk analysis, and an understanding of relevant ethical principles.

Downloads

References

Berger, T. M. M. (2018). IPSAS Explained: A Summary of International Public Sector Accounting Standards. John Wiley & Sons. https://books.google.de/books/about/IPSAS_Explained.html?id=GcN1AQAACAAJ&redir_esc=y

Bovens, M. (2010). Two Concepts of Accountability: Accountability a virtue and as a Mechanism. West European Politics, 33(5), 946-967. https://doi.org/10.1080/01402382.2010.486119

Dunleavy, P., & Hood, C. (1994). From old public administration to new public management. Public Money & Management, 14(3), 9-16. https://doi.org/10.1080/09540969409387823

Hajiha, Z., & Soltani, M. (2014). A Perspective on Cultural Dimensions of Accounting. Journal of Accounting and Social Interests, 4(4), 83-108. https://en.civilica.com/doc/969997/

Hasanmaleki, A., Abdoli, M., Abdollahi, A., & Abbasi, A. (2020). Developing a qualitative model of auditors' professional skepticism: A perspective of auditing partners and managers of Iranian Association of Certified Public Accountants. aapc, 5(9), 55-79. https://doi.org/10.29252/aapc.5.9.55

Hillier, D. (1996). From cash to accrual: The Canadian experience [Occasional Paper 3 in Perspectives on Accrual Accounting]. https://www.ifac.org/system/files/publications/files/no-3-perspectives-on-acc.pdf

Hofstede, G. (1980). Culture's consequences: International differences in work-related values. Sage Publication. https://books.google.com/books/about/Culture_s_Consequences.html?id=Cayp_Um4O9gC

Hood, C. (1995). The "New Public Management" in the 1980s: Variations on a theme. Accounting, Organizations and Society, 20(2-3), 93-109. https://doi.org/10.1016/0361-3682(93)E0001-W

Kamyabi, Y., Malekian, E., & Javady Nia, A. (2023). Investigating the Role of Professional Experience and Skepticism in Reducing the Effect of Information Presentation on the Quality of Auditors' Judgment: An Experimental Study of Auditors' Behavior. Financial Accounting Knowledge, 10(2), 1-37. https://jfak.journals.ikiu.ac.ir/article_3132.html?lang=en

Karimabadi, M., Hajiha, Z., Jahangirnia, H., & Gholami Jamkarani, R. (2024). Model of the Code of Professional Conduct for Independent Auditors Based on a Critical Perspective. Judgment and Decision Making in Accounting, 3(9), 105-124. https://journals.iau.ir/article_709477.html?lang=en

Malekipour Gharbi, M., Ghodrati, H., Jabbari, A., Panahian, H., & Farzin Far, A. A. (2023). Designing a process model of socio-ethical responsibilities in audit firms (qualitative approach: grounded theory). Financial Economics, 17(65), 177-194. https://www.magiran.com/paper/2651135/designing-a-process-model-of-social-ethical-responsibilities-in-audit-institutions-qualitative-approach-foundational-data-theory?lang=en

Namazi, M., & Momtazian, A. (2022). Identification and Ranking Factors Affecting Professional Judgment and Decision-Making of Auditors. Journal of Management Accounting and Auditing Knowledge, 11(43), 189-207. https://www.jmaak.ir/article_19983.html?lang=en

Ouda, H. A. G. (2015). Results-based systems are the path towards results-oriented. International Journal on Governmental Financial Management, 15(1), 46-69. https://www.researchgate.net/publication/303390433_Results-Based_Systems_Are_the_Path_Towards_Results-Oriented_Government

Parveen, S., Satti, Z., Subhan, Q., & Jamil, S. (2020). Exploring market overreaction, investors' sentiments and investment decisions in an emerging stock market. Borsa Istanbul Review, 20(3), 224-235. https://doi.org/10.1016/j.bir.2020.02.002

Rocciolo, F., Gheno, A., & Brooks, C. (2019). Optimism, volatility and decision-making in stock markets. International Review of Financial Analysis, 66(5), 1-11. https://doi.org/10.1016/j.irfa.2019.05.007

Sedighi, A., Babajani, J., Delavar, A., & Barzideh, F. (2023). Presenting and validating a pattern for auditing professions' social status in Iran. Empirical Research in Accounting, 12(4), 1-26. https://en.civilica.com/doc/1606156/

Sha, N., & Yousoof, I. (2021). Behavioral Investor Types and Financial Market Players in Oman. Journal of Asian Finance, Economics and Business, 8(1), 285-294. https://www.researchgate.net/publication/348409084_Behavioral_Investor_Types_and_Financial_Market_Players_in_Oman

Wan, L., Zheng, H., & Kong, D. (2025). Methodological Innovation in Government Environmental Auditing Through Biomechanical Principles: An Approach to Environmental Impact Performance Evaluation. Molecular & Cellular Biomechanics, 22(4), 1704. https://doi.org/10.62617/mcb1704

Wang, L., & Smith, J. (2025). Social Role Theory and Auditor Environmental Accountability: A Multinational Study. Journal of Accounting Research, 63(1), 123-150.

YanFang, J., JieYuan, J., JimmyYang, J., & ShangjunYing, J. (2022). Crash-based quantitative trading strategies: Perspective of behavioral finance. Finance Research Letters, 45, 102185. https://doi.org/10.1016/j.frl.2021.102185

Zare, I., Golami-Jamkarani, R., Moradi, M., Babaaeifard, A., & Jahangirnia, H. (2021). Accountability in accounting from the perspective of Islam by focusing on Structuration Theory. Islamic Finance Researches (IFR), 10(2), 831-855. https://ifr.isu.ac.ir/article_75922.html?lang=en

Zare, I., Moradi, M., Gholami Jamkarani, R., Babaeifard, A., & Jahangirnia, H. (2022). An Islamic-Social Model of Accountability in Accounting. Governmental Accounting, 8(2), 37-58. https://gaa.journals.pnu.ac.ir/article_8397.html?lang=en

Downloads

Additional Files

Published

Submitted

Revised

Accepted

Issue

Section

License

Copyright (c) 2025 Lela Arab (Author); Reza Sotudeh (Corresponding Author); Abbasali Haghparast, Alireza Hirad (Author)

This work is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License.