Identifying the New and Practical Components and Dimensions of Entrepreneurship in the Banking Network with a Digital Technology Approach

Keywords:

entrepreneurship, banking network, digital technology approachAbstract

Objective: The aim of this study is to identify the components and dimensions of entrepreneurship within the banking network from a digital technology perspective.

Methodology: This research is categorized as applied research, qualitative in nature, and employs a descriptive survey approach. The statistical population consists of all experts specializing in information technology and entrepreneurship within the banking industry. Following Strauss and Corbin's guidelines, 15 participants were selected through snowball sampling. Data collection was conducted through both library research and fieldwork, utilizing semi-structured interviews. The interviews were analyzed using MAXQDA software and a systematic coding process, complemented by the fuzzy Delphi method. To enhance the reliability and validity of the questionnaire, preliminary consultations were held with academic professors, who reviewed and provided feedback on the questions. Subsequently, a subset of the statistical population was given the revised questionnaire to address and resolve any ambiguities, before distributing the final version. Cronbach's alpha coefficient was employed to assess the reliability of the measurement instrument.

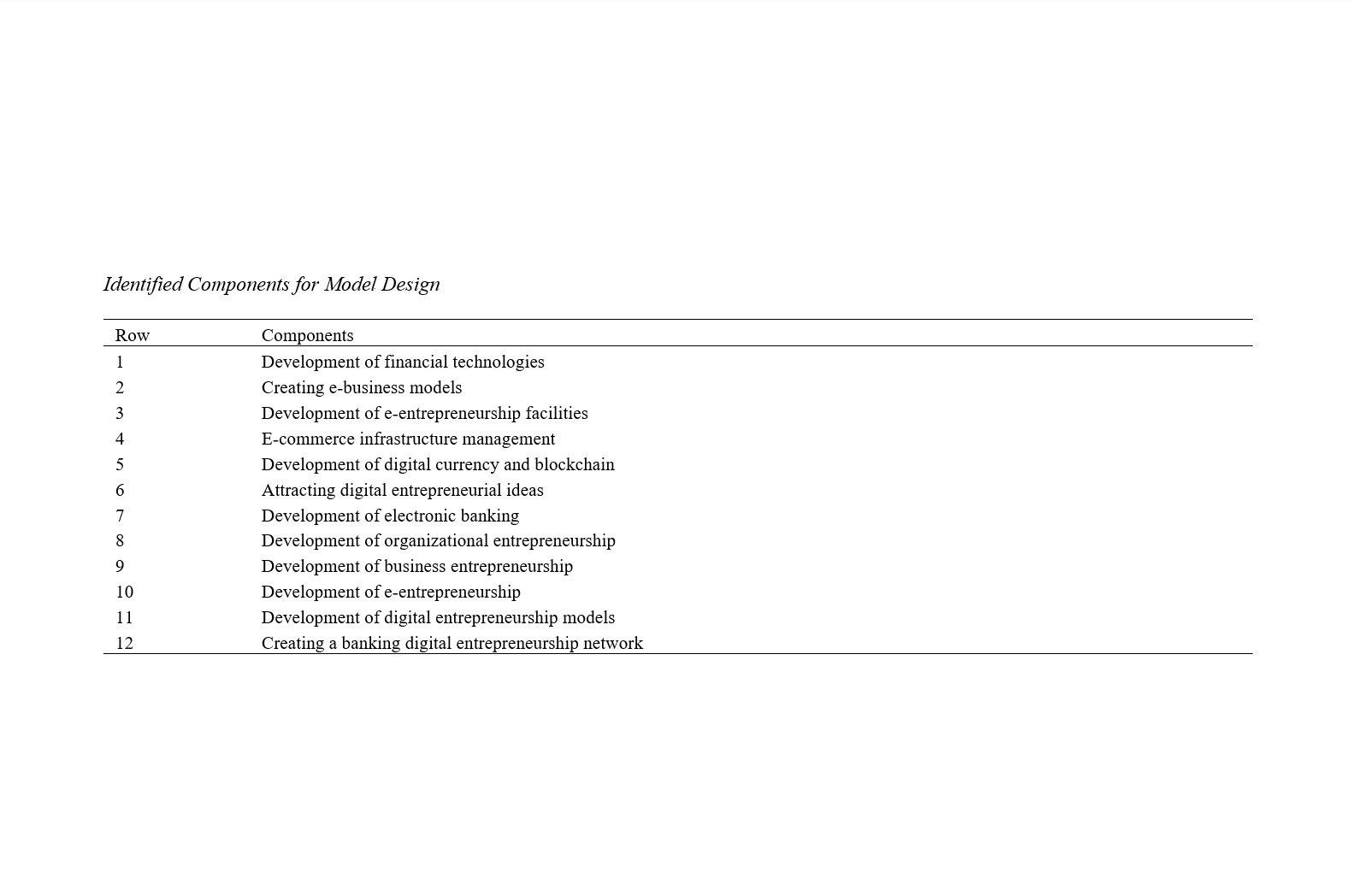

Findings: The research findings indicate that the establishment and expansion of digital entrepreneurship by banks are influenced by various dimensions, including the development of financial technologies, the creation of e-business models, the provision of e-entrepreneurship facilities, e-commerce infrastructure management, digital currency and blockchain development, the adoption of digital entrepreneurship ideas, and the advancement of electronic banking.

Conclusion: It can be concluded that these dimensions are potentially pivotal in forming a digital banking entrepreneurial network.

Downloads

References

Al-Naimi, A. A., Al-Masaeed, A. A., & Al-Eitan, G. N. (2021). The impact of banking lending on the development of entrepreneurship: Analysis study on the Jordanian small and medium enterprises. Materials Today: Proceedings, 1-7. https://doi.org/10.1016/j.matpr.2021.04.520

Almeida, F. (2024). Causes of Failure of Open Innovation Practices in Small- And Medium-Sized Enterprises. Administrative Sciences, 14(3), 50. https://doi.org/10.3390/admsci14030050

Ariaparsa, M., & Ebramihi, H. (2023). Technology Transfer Process in the Context of Open Innovation Paradigm. Dynamic Management and Business Analysis, 2(2), 28-39. https://doi.org/10.22034/dmbaj.2024.2022823.1017

Asadullah, M., Sanavi Fard, R., & Hamidizadeh, A. (2018). Electronic banking business model based on the emergence of fintechs and financial startups. Technology Development Management Quarterly, 7(2), 195-248. https://www.sid.ir/paper/260252/fa

Asgharinezhad, S., Rezghi Shirsavar, H., & Khanzadi, K. (2024). Investigating the Status of Internet of Things Development in Schools based on the Future Research. Sociology of Education, 10(1), 152-160. https://doi.org/10.22034/ijes.2024.2017649.1517

Badi, A., & Dastjard, A. (2012). Presenting a conceptual model of technology acceptance in electronic banking based on TPM, TAM, TAM2, TRA. Electronic Business and Economy Conference,

Ben Youssef, A., Boubaker, S., Dedajc, B., & Carabregu-Vokshi, M. (2021). Digitalization of the economy and entrepreneurship intention. Technological Forecasting & Social Change, 143, 1-14. https://doi.org/10.1016/j.techfore.2020.120043

Cornett, M. M., & Saunders, A. (2011). Financial Institutions Management: A Risk Management Approach (7th ed.). McGraw-Hill/Irwin. https://www.mheducation.com/highered/product/financial-institutions-management-risk-management-approach-saunders-cornett/1264413041.html

Dehghan Dehnavi, H., Heydarianizadeh, A., & Karaminia, M. (2019). Identifying and prioritizing factors affecting the improvement of e-entrepreneur organization: Case study of export banks in Yazd province. The 11th National Conference on New Approaches in Management, Economics and Accounting, Babol.

Ghezali, F., & Boudi, A. (2021). Achieving banking entrepreneurship through the marketing mix: Case of some Algerian commercial banks. Revue Organisation & Travail, 10(2), 338-351. https://www.asjp.cerist.dz/en/downArticle/147/10/2/159947

Haji Shahverdi, D., Zamardian, G., Fallah Shams Lialestani, M., & Hanifi, F. (2018). Designing a systematic banking crisis early warning system in Iran's financial market (using Markovian chains). Financial Economics Quarterly, 13(47), 135-154. https://journals.iau.ir/article_668628.html

Hakimi, N., Fathi, Z., & Pourbahrami, B. (2024). Application of Metacombination Technique in the Financial Flow Based on Blockchain Technology in the Hospital Ecosystem. Dynamic Management and Business Analysis, 2(4), 74-93. https://doi.org/10.22034/dmbaj.2024.2035663.1036

Hoffman, B. W., Sellers, R. D., & Skomra, J. (2018). The impact of client information technology capability on audit pricing. International Journal of Accounting Information Systems, 29, 59-75. https://doi.org/10.1016/j.accinf.2018.03.002

Kordnori, A. H., Edalatian Shahriari, J., Azizi, M., & Kabaranzadeh Ghadim, M. (2019). Designing a conceptual business model in development banks with an international entrepreneurship approach. Financial Economics, 14(53), 157-172. https://journals.iau.ir/article_682974.html

Losová, V. Š. (2024). The Role of Open Innovation In addressing Resource Constraints in Healthcare: A Systematic Literature Review. Journal of Health Organization and Management, 38(2), 150-175. https://doi.org/10.1108/jhom-06-2023-0203

Parsaiyan, A., & Arabi, S. M. (2018). Fundamentals of organization theory and design. Cultural Research Office.

Pirani, M., & Hosseini, M. (2012). Presenting a comprehensive service quality evaluation scale in electronic banking. Electronic Business and Economy Conference,

Reshadi, F., & Dasgar, M. (2012). Review and review of factors affecting the adoption of electronic banking. Electronic Business and Economy Conference,

Silva, V. L., Kovaleski, J. L., & Pagani, R. N. (2019). Technology Transfer and Human Capital in the Industrial 4.0 Scenario: A Theoretical Study. Future Studies Research Journal: Trends and Strategies, 11(1), 102-122. https://doi.org/10.24023/FutureJournal/2175-5825/2019.v11i1.369

Tavazoei Far, A., Shihaki Tash, M., & Keshavarz, S. (2018). Identifying drivers effective on digital entrepreneurship in small and medium businesses with a hybrid approach. Science and Technology Policy, 09(3), 61-72. https://www.sid.ir/paper/364495/fa

Wahyono, T. (2024). Digital Transformation in MSMEs in Indonesia: The Importance of Commitment to Change. International Journal of Social Service and Research, 4(01), 378-384. https://doi.org/10.46799/ijssr.v4i01.703

Weber, E., Krehl, E. H., & Büttgen, M. (2022). The digital transformation leadership framework: Conceptual and empirical insights into leadership roles in technology‐driven business environments. Journal of Leadership Studies, 16(1), 6-22. https://onlinelibrary.wiley.com/doi/abs/10.1002/jls.21810

Xiao, J. (2019). Digital transformation in higher education: critiquing the five-year development plans (2016-2020) of 75 Chinese universities. Distance Education, 40(4), 515-533.

Xiao, J. (2023). How Digital Transformation Improve Government Performance: The Mediating Role of Partnering Agility. IEEE Access, 11, 59274-59285. https://doi.org/10.1109/access.2023.3284793

Downloads

Additional Files

Published

Submitted

Revised

Accepted

Issue

Section

License

Copyright (c) 2025 Afshin Nobakht (Author); Majid Nasiri (Corresponding Author); Parviz Saeedi (Author)

This work is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License.