Ranking Stressors and Coping Hierarchies in Families Facing Financial Instability

Keywords:

Financial instability, family stress model, coping hierarchies, emotional resilience, mixed-method research, IraqAbstract

Objective: This study aimed to identify, categorize, and rank the primary stressors and coping hierarchies experienced by families facing financial instability using a mixed-method exploratory approach.

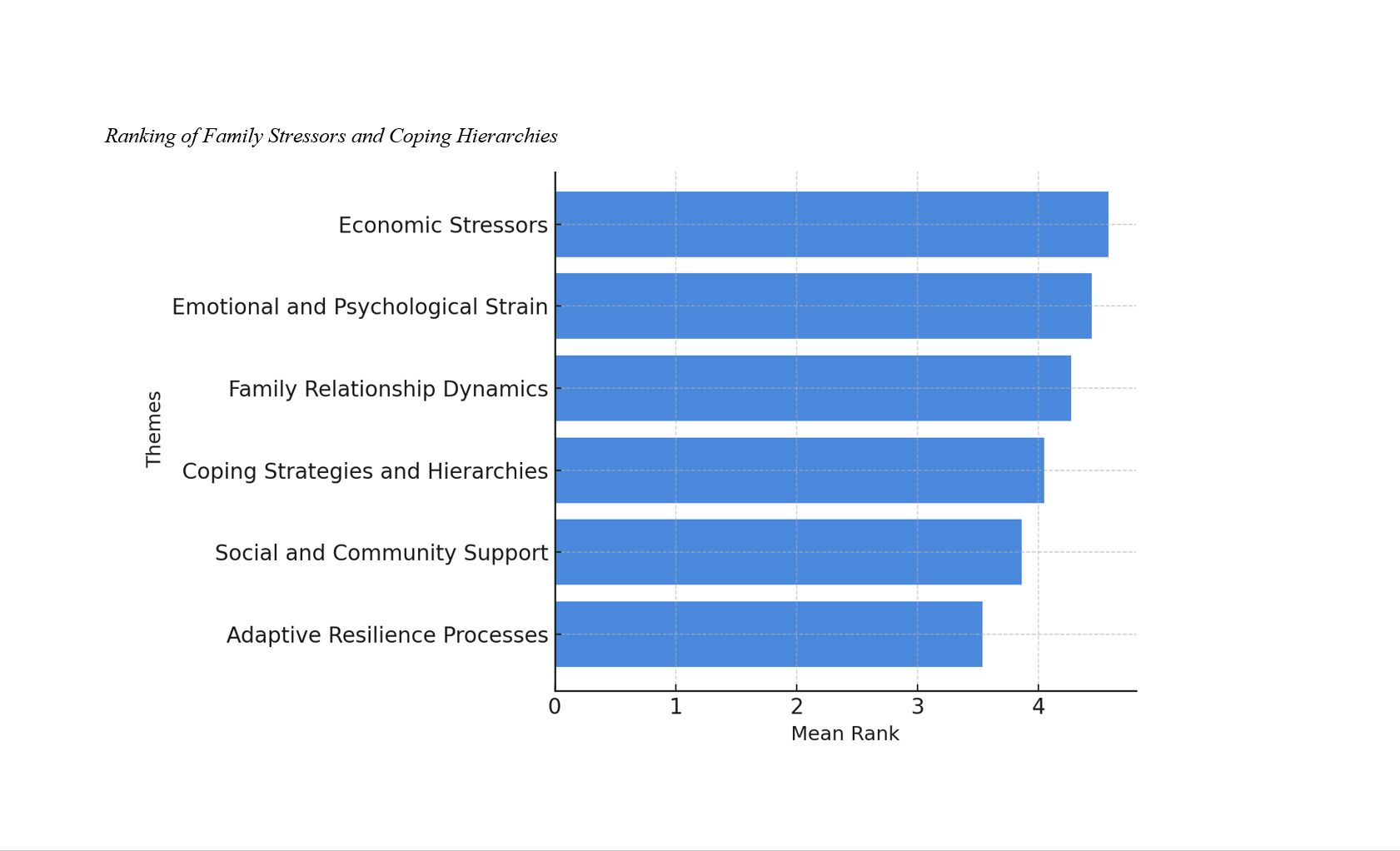

Methods and Materials: The research followed a sequential mixed-method design. In the first phase, a qualitative literature-based analysis was conducted to identify core themes and subthemes related to financial distress and coping strategies. Data were extracted through a systematic literature review and analyzed thematically using NVivo 14 software until theoretical saturation was reached. Six main thematic categories emerged from the analysis: economic stressors, emotional and psychological strain, family relationship dynamics, coping strategies and hierarchies, social and community support, and adaptive resilience processes. In the second phase, a quantitative ranking was performed among 210 participants from Iraq selected through purposive sampling. Data collection employed a structured questionnaire derived from qualitative results. SPSS version 26 was used to perform Friedman’s test and Kendall’s coefficient of concordance (W) to determine the statistical ranking and consistency of participants’ responses.

Findings: The analysis revealed significant differences across the six thematic domains (χ² = 112.47, p < 0.001; W = 0.71). Economic stressors received the highest mean rank (4.58), followed by emotional and psychological strain (4.44) and family relationship dynamics (4.27). Coping strategies and hierarchies (4.05) and social and community support (3.86) followed, while adaptive resilience processes ranked lowest (3.54). The strong Kendall’s coefficient indicated a high level of agreement among respondents, confirming a shared perception of financial instability as a multidimensional challenge with economic and emotional dimensions.

Conclusion: The study demonstrated that financial instability generates complex, hierarchical stress patterns within families, with economic hardship triggering psychological strain and relational tension. Enhancing both structural financial security and emotional resilience is essential for sustainable family adaptation.

Downloads

References

Asni, K. (2025). Bridging the Living Income Gap for Cocoa and Palm Oil Farmers in Rural Post-Disaster Aceh. E3s Web of Conferences, 651, 02001. https://doi.org/10.1051/e3sconf/202565102001

Ávila, R. C., & Guillén, Á. S. (2023). Social Economy Resilience Facing the COVID-19 Crisis. 234-259. https://doi.org/10.1093/oso/9780192868343.003.0010

Baim‐Lance, A., Addison, D., Archer, N. P., Gordon, P., Duke, S. I., Shubert, V., Nash, D., & Robertson, M. (2023). Integrating a Resilience Framework to Assess Implementation of a Novel HIV Care Re-Engagement Model in NYC. JAIDS Journal of Acquired Immune Deficiency Syndromes, 94(4), 308-316. https://doi.org/10.1097/qai.0000000000003285

Bakalo, I. (2025). Stress Testing of the Banking System of Ukraine: Tools, Scenarios and Results in Wartime Conditions. Scientific Notes of Ostroh Academy National University Series Economics, 1(37(65)), 37-42. https://doi.org/10.25264/2311-5149-2025-37(65)-37-42

Chatterjee, S., & Roy, B. (2025). Shifting Family Dynamics: Examining Family Structure and Its Social and Emotional Consequences. International Journal for Multidisciplinary Research, 7(5). https://doi.org/10.36948/ijfmr.2025.v07i05.56269

Delgado-Gallegos, J. L., Padilla-Rivas, G. R., Zúñiga-Violante, E., Avilés-Rodríguez, G., Arellanos-Soto, D., Villareal, H. F., María de los Ángeles, C.-L., Romo-Cárdenas, G. S., & Islas, J. F. (2021). Teaching Anxiety, Stress and Resilience During the COVID-19 Pandemic: Evaluating the Vulnerability of Academic Professionals in Mexico Through the Adapted COVID-19 Stress Scales. Frontiers in Public Health, 9. https://doi.org/10.3389/fpubh.2021.669057

Dreichuk, M., & Ситник, Й. (2025). Socio-Economic Assessment of Human Resource Management Effectiveness Under Uncertainty. Three Seas Economic Journal, 6(2), 40-45. https://doi.org/10.30525/2661-5150/2025-2-7

Dugbartey, A. N. (2025). Systemic Financial Risks in an Era of Geopolitical Tensions, Climate Change, and Technological Disruptions: Predictive Analytics, Stress Testing and Crisis Response Strategies. International Journal of Science and Research Archive, 14(2), 1428-1448. https://doi.org/10.30574/ijsra.2025.14.2.0563

Ene, G.-V. B., Stoia, M. A., Cojocaru, C., & Todea, D. A. (2025). SMART Multi-Criteria Decision Analysis (MCDA)—One of the Keys to Future Pandemic Strategies. Journal of clinical medicine, 14(6), 1943. https://doi.org/10.3390/jcm14061943

Farounbi, B. O. (2025). Macroeconomic Modeling Framework Supporting Strategic Allocation of Private Credit Across Global Markets. International Journal of Advanced Economics, 7(9), 287-305. https://doi.org/10.51594/ijae.v7i9.2058

Finch, J. E., Kuo, P. X., & Akhavein, K. (2025). Economic Hardship and Children’s Cognitive Outcomes During COVID-19: The Family Stress Model and the Compensatory Role of Family Cohesion. Journal of Family Psychology. https://doi.org/10.1037/fam0001348

Hazarika, I., Bhandari, R., Rao, P. H., & Porwal, T. (2025). Mapping Resilience Pathways: A Conceptual Framework for Portfolio Risk Management in Microenterprise Lending During Economic Shocks. Enterprise Development and Microfinance, 35(1), 1-20. https://doi.org/10.3362/1755-1986.25-00001

Hernández, F. P., Ares, A. M. C., & Neira, M. Á. A. (2025). Tax Base Dynamics and Revenue Trends in Spain: A Comparative Analysis of Major Taxes (1995–2023). Journal of Tax Reform, 11(3), 692-712. https://doi.org/10.15826/jtr.2025.11.3.223

Kaewhanam, P., Kaewhanam, K., Purnomo, E. P., Thongmual, N., Pongsiri, A., & Norrapoke, T. (2025). Structural Analysis of Key Factors in Poverty Alleviation for Policy Development in Persistently Impoverished Provinces in Thailand. Frontiers in Sustainability, 6. https://doi.org/10.3389/frsus.2025.1620149

Khammassi, I., Boufateh, T., Naoui, K., Alrawad, M., & Lutfi, A. (2024). The Role of Stress Tests in Enhancing Bank Transparency: A Comparative Study of Islamic and Conventional Banks. Economics, 12(1), 71-100. https://doi.org/10.2478/eoik-2024-0003

Madiwalar, M. S. (2024). Rbi's Regulatory Framework: Balancing Stability and Growth in Indian Banking. Shodhkosh Journal of Visual and Performing Arts, 5(2). https://doi.org/10.29121/shodhkosh.v5.i2.2024.6110

Makola, Z. (2025). A Framework for Enhancing the Psychological and Emotional Well-Being of South African Entrepreneurs. 385-416. https://doi.org/10.4018/979-8-3693-9516-5.ch019

Mansour, M. (2025). Introducing Integrative Health in a Crisis-Stricken Country Like Lebanon: Can It Bring Relief? Ejmhr, 3(3), 105-108. https://doi.org/10.59324/ejmhr.2025.3(3).15

Matthew, A. D., Opia, F. N., Matthew, K. A., Kumolu, A. F., & Matthew, T. F. (2021). Cancer Care Management in the COVID-19 Era: Challenges and Adaptations in the Global South. International Journal of Multidisciplinary Research and Growth Evaluation, 2(6), 581-588. https://doi.org/10.54660/.ijmrge.2021.2.1-581-588

Nikoloski, Z., Cheatley, J., & Mossialos, E. (2021). Financial Risk Protection and Unmet Healthcare Need in Russia. International Journal of Health Policy and Management. https://doi.org/10.34172/ijhpm.2021.72

Nwachukwu, P. S. (2021). Risk Asset Booking and Portfolio Monitoring: Global Best Practices and a Framework for Sustainable Banking Risk Management. International Journal of Multidisciplinary Research and Growth Evaluation, 2(5), 598-612. https://doi.org/10.54660/.ijmrge.2021.2.5.598-612

Raji, N. O. (2025). A Systems Approach to Understanding How Poverty and Parental Stress Contribute to Family Trauma. International Journal of Science and Research Archive, 17(1), 1051-1075. https://doi.org/10.30574/ijsra.2025.17.1.2906

Rizky, U. D., Mongid, A., Suhartono, S., & Sistiyarini, E. (2023). Macro-Economic Stress Test for Islamic Rural Bank: A Proposed Framework. International Journal of Medical Science and Health Research, 07(04), 55-64. https://doi.org/10.51505/ijebmr.2023.7805

Saberi, P., Ming, K., Arnold, E. A., Leddy, A. M., & Weiser, S. D. (2023). Extreme Weather Events and HIV: Development of a Conceptual Framework Through Qualitative Interviews With People With HIV Impacted by the California Wildfires and Their Clinicians. BMC public health, 23(1). https://doi.org/10.1186/s12889-023-15957-5

Sari, D. P., B, I. B. I., & Sumarni, Y. (2025). Impact of Low Papaya Prices on the Socio-Economic Conditions of Farmers: An Atlas.ti Analysis. Bima Journal (Business Management & Accounting Journal), 6(1), 415-426. https://doi.org/10.37638/bima.6.1.415-426

Αντωνιάδης, Α. (2025). Breaking the Cycle: Financial Stress, Unsustainable Growth, and the Transition to Sustainability. Sustainability, 17(17), 7830. https://doi.org/10.3390/su17177830